The core values of parenting haven’t changed much over the years luckily. Our children still resort to lullabies to go to sleep, are picky eaters as toddlers and spread toys all over the floor- setting us off on a wild rage! But the one thing that has changed, tremendously over the years is the cost of parenting. Even if you are a parent- have you given it an actual thought? How much would you have to spend till your child turns 18? Don’t reach for the calculator. We have done it for you- click here to find out.

HSBC’s Value of Education report gave us a glimpse of the sacrifices today’s parents are willing to make for their child to help them pursue their higher education. This research that was conducted among 24000 parents across the globe, tells us what parents are planning and how they are preparing for their child’s future. It’s time you start making that excel sheet- to plan for your child!

You may also like: How to financially plan for your child’s future?

Planning ahead- the early bird helps catch the worm!

The survey conducted among parents revealed that around 71% had already started making plans for their child's higher education while 60% had started planning on the funding even before their child began their primary education. And on the bright side- Indian parents are leading the way- the highest proportions of parents with at least one child in paid-for education are in our country (Over 96% of the respondents).

So, how much should I really be saving?

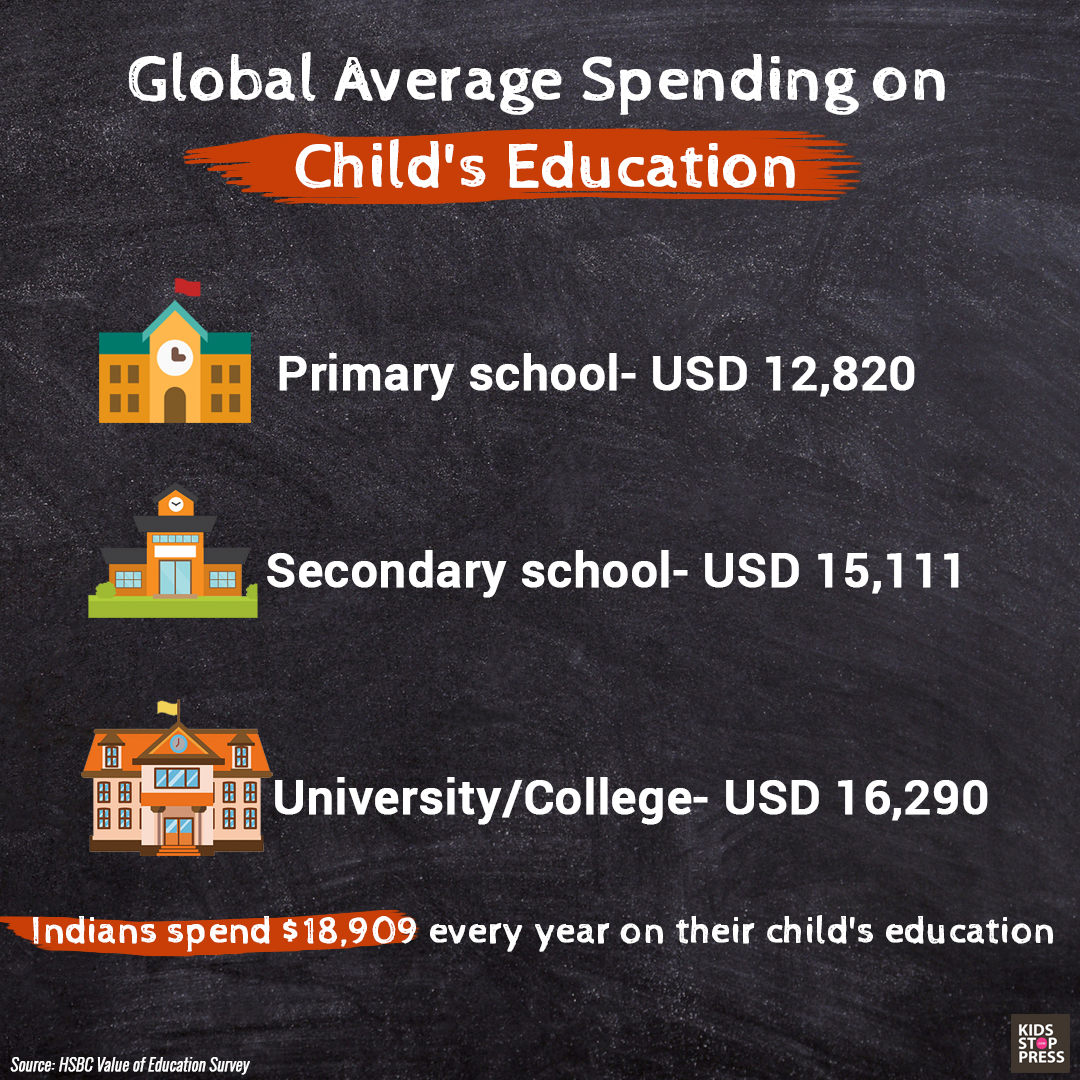

The numbers are out- and here's where you make a note. On an average, it has been observed that including primary and secondary education and a university degree will roughly cost you around $44,221. This is the average global spending by parents on their child's education. The numbers are spiked up in countries like Hong Kong, UAE, Singapore and the United States. The average numbers for India are at $18,909 that roughly translates to around 13 lakhs.

Postgraduation- what do parents think about this:

The one thing we know for certain in our country is the importance of education and how a strong academic background is mandatory in an average Indian household. The survey shows that more than 78% of parents across the globe see their child's post-graduation as a gateway to securing a good job in their future- with the highest proportions coming in from China, Indian (91% each) and Mexico (90%).

You may also like: Top 10 skills your kids will need in 2020

So, how are parents saving up for their child's future?

Every parent is coming up with different ideas and savings plans to ensure their child has the right to the best education possible. The savings vary from day-to-day regular earnings, special investment plans, inheritance and others. Here's how parents across the globe are funding their child's education. Find out.

The key takeaway from the report is to start early. It's never too early to start planning for your child's secure future with little savings right from the beginning.

The key takeaway from the report is to start early. It's never too early to start planning for your child's secure future with little savings right from the beginning. The report also says how over 34% of parents had wished they had started saving earlier for their child's future. Parents are also cutting down on their leisure expenses to ensure they are saving enough for the rainy days ahead.

What are your plans for your child's future? How are you saving? What word of advice/suggestion do you have for fellow parents? Let us know in the comments below.

You may also like: Should having a child alter your spending habits?